Argent Quarterly Investment Commentary – September 2025

“To swim a fast 100 meters, it’s better to swim with

the tide than to work on your stroke.”

– Warren Buffet

After a rocky start to the year given concerns over tariffs, inflation and large federal deficits, the global stock market has staged a strong rebound—with the third quarter of 2025 marking its best performance in more than a decade. Leading the charge have been companies with an artificial intelligence (AI) story; producing a surge of noteworthy price gains driven by remarkable innovation paired with underlying strength in both revenues and earnings. Companies without an AI narrative have had more tepid gains, frustrating many active stock managers who have been challenged to keep up. Bottom line: swimming with the AI tide in 2025 has not just been a component of performance, it has been a prerequisite. We are reminded of the great investor, Jeremy Grantham’s comment, “Ninety percent of what passes for brilliance or incompetence in investing is the ebb and flow of investment style.” Overwhelmingly, AI is the current investment style du jour.

“The smarter we make the A.I., the less it wants to do our jobs.”

According to JP Morgan research, AI stocks have accounted for seventy-five percent of S&P 500 Index returns since November 2022, when ChatGPT launched. Even more amazing, AI stocks have represented eighty percent of the earnings growth in the S&P 500 Index over that time period, and ninety percent of capital spending has been related to AI. AI is so transformative that data center construction nationwide is now outpacing office construction. AI is also having a huge impact on the power grid – AI has a monstrous appetite for power, and natural gas and nuclear plants take years if not decades to build.

At Argent, we have steadily transitioned portfolios to take increasing advantage of AI spending. Candidly, with hindsight, we wish we had done it even faster. All that said amidst this AI euphoria, we remind ourselves of what Bill Gates said about technology, “We always over-estimate the change that will occur over the next two years and underestimate the change that will occur in the next ten.”

Given the overall run in the U.S. stock market, it is logical to expect some moderation in returns near term, or even one of those unpleasant corrections that occur with regularity. To that point, valuations are on the high side, tariff uncertainty persists, and wars continue overseas. Closer to home, housing, trucking, and our labor markets are softer than desired, and mortgage rates remain higher than desired while budget deficits continue on their unsustainable long-term path. Clearly, there is a plethora of legitimate reasons to be concerned.

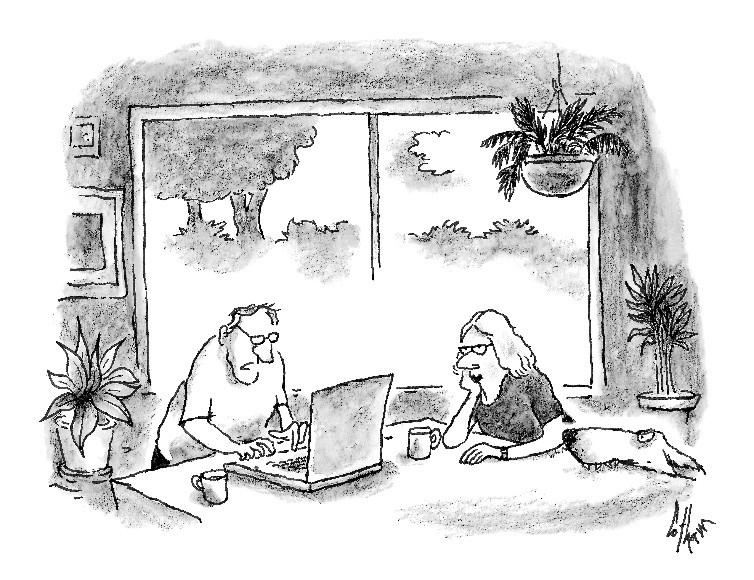

“They say registering online should take ten minutes to two days, depending on my computer skills.”

“They say registering online should take ten minutes to two days, depending on my computer skills.”

Yet amidst all this, we still feel optimistic, and remind ourselves that nervous energy – the temptation to do something – has historically been the great destroyer of wealth for long-term investors. As we see things, the U.S. economy is still fairly healthy. Goldilocks might note that it is not too hot, but also not too cold. On the positive side, we had one interest rate cut by the Fed in September, and two more seem likely this year; perhaps more next year. Tariffs this year have had an impact, but to-date have not had the negative impact on inflation many feared. Even the weak dollar this year is not all bad news. Multinational firms can turn overseas profits into higher earnings when they convert their foreign earnings back to dollar denomination. Thus, talk of a recession, which many have been predicting since 2022, seems premature against this backdrop.

Argent enjoyed two very strong years of absolute and relative performance in 2023 and 2024. This year has been fine on an absolute basis, but frustrating relatively, not just for us, but for many active managers. If one looks at our positions, earnings for all portfolios have been excellent, the top lines are doing well and valuations for our stocks, while somewhat elevated, are justifiable in this environment. In comparison, many of the big winners in the stock market this year are what are thought of as lower quality stocks – those with less price stability, higher use of debt and lower return on equity. We have always been a firm focusing on quality stocks – we know the tide, over time, is with such companies, so we will continue to rely on what we know works best rather than alter our stroke.

PDF Version: Investment Newsletter – September 2025

(c) 2025, Argent Capital Management

Argent Capital Management, LLC is required by law to disclose all pertinent information on the firm’s operation in our Summary Disclosure Statement. Past performance is no guarantee of future results. Copies of all pertinent disclosure statements including performance are available upon request or available at www.argentcapital.com