Market Overview – April 2023

Recently, there has been a good deal of news coming out of the banking industry. I would like to address what has been happening, particularly the roots of that volatility. The real concern regarding banks began with the demise of Silicon Valley Bank (SVB). SVB was a highly touted institution with a unique franchise – a bank located in the heart of the tech world, catering to the well-heeled venture capital community. Somewhat ironically, that unique and coveted customer base contributed to the collapse of the bank.

To frame the issues that affected SVB and other banks today, it may be helpful to take a step back and explain the drivers of a bank and its profits. As you know, banks lend money. Banks make money by charging a higher rate of interest on their loans compared to the interest they pay for deposits – the primary funding source for bank loans. That profit, the difference between what a bank charges for its loans and the cost of its funds, is called a net interest margin. Banks generally borrow 90% of the money they use to fund a loan and put up 10% of their equity. In a perfect world, as long as the borrower repays his or her loan and the bank has a positive net interest margin, the bank is in good shape.

A little more than a year and a half ago, interest rates were quite low and had been quite low for some time. What that meant was banks offered little in the way of interest for deposits. What SVB did in that environment was make long-dated loans, for instance, mortgage loans, with an average life of 7+ years. By lending at longer maturities, SVB was able to capture a bit more in net interest margin or profit.

The problems for SVB and its loan book were exposed when the Federal Reserve raised short-term rates aggressively to battle inflation. During a period of rising interest rates, the value of debt, whether it be bonds or loans, falls. As long as bond holders or lenders hold to maturity, they are fine because they will get paid the face value of their bond or the full value of their loan. If, however, they are forced to sell their bond or loan in the interim, they will incur a loss. With the advent of higher interest rates, all banks have unrealized losses on their books. SVB, however, was an extreme example.

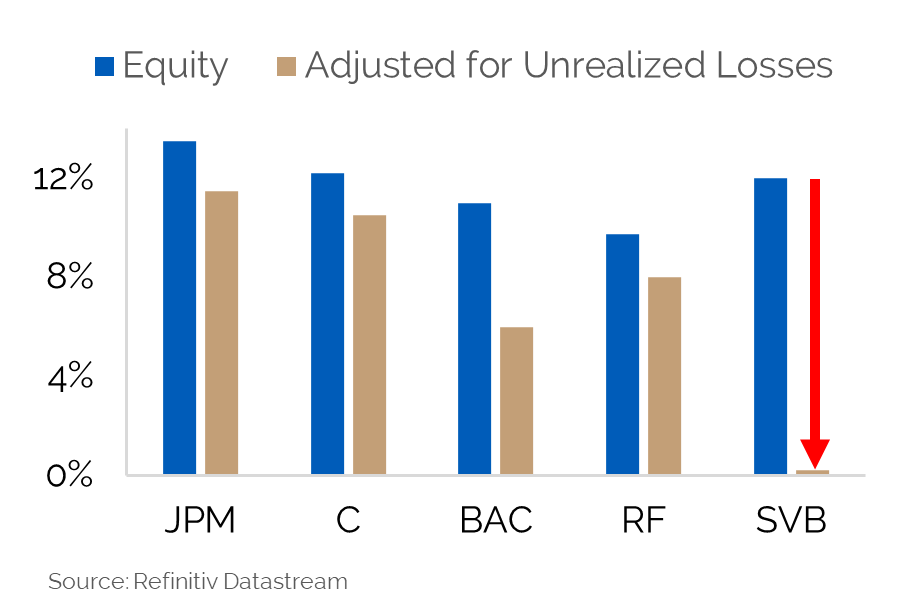

The chart above shows equity in blue and equity less unrealized losses in brown for a select group of banks; JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), Regions Financial (RF) and Silicon Valley Bank (SVB). There are two points to make from the chart. The first, as mentioned before, is that all banks had unrealized losses, again because of rising interest rates. The second is that adjusting for those unrealized losses, the value of SVB’s equity was essentially $0.

The final nail in SVB’s coffin was related to its deposit base. As you know, the Federal Deposit Insurance Corporation (FDIC) guarantees deposits up to $250,000. Because of SVB’s clients, venture capitalists and VC-funded businesses, over 90% of the bank’s deposits were greater than the FDIC limit. When these generally financially savvy depositors caught wind that SVB’s equity was essentially zero, they pulled their money, creating a run on the bank and, in very short order, the demise of SVB.

Since that time, we have seen other banks experience significant withdrawals of their deposits as individuals sought higher returns on their cash. This led to the FDIC-engineered forced sale of First Republic to JPMorgan Chase. How this will all play out is unclear. What is certain is that we will remain vigilant about the risks in our portfolios in this period of banking flux and will look for opportunistic long-term investments for our clients should the markets overreact.

As a reminder, we are 100% employee-owned, and we thank you for your business and your interest. If you like our market letters, videos by Ward Brown and my podcast, ‘Conversations with Ken,’ we hope you will share them with friends. In addition, whether you’re ready to invest hundreds of dollars or millions of dollars, our time-tested Mid Cap strategy has a variety of vehicles that provide convenient ways to invest. For more information on Mid Cap and our other four U.S equity strategies – Large Cap, Dividend Select, Focused Small Cap and SMID Cap, please contact [email protected].

Sincerely,

Ken Crawford

Portfolio Manager

PDF Version: Market Overview April 2023