Market Overview – August 2023

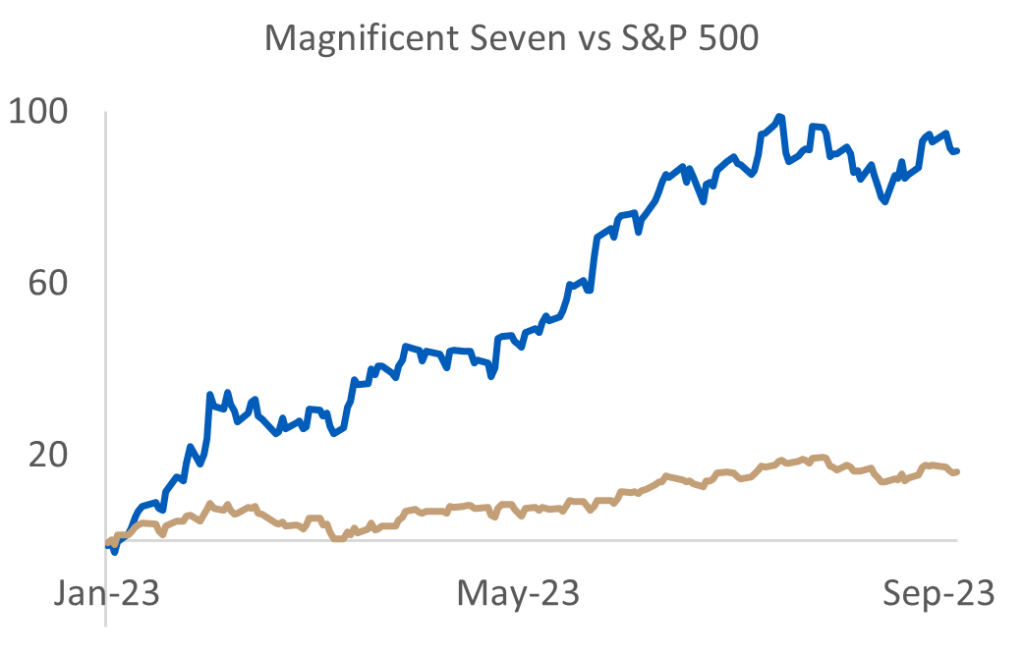

The market followed its rather circuitous path in August. The good news is that year-to-date, the market is up nicely, a welcome relief from the difficult 2022 results. The bad news is that the debate around the direction of the economy and inflation continues, creating uncertainty and months like August, where the market fell nearly 1.6%. In addition to economic uncertainty, there is concern around the fact a very few giant companies, some calling them the ‘Magnificent Seven,’ are driving much of the results for the year.

For those of you not in the know, the Magnificent Seven are Amazon, Alphabet (aka Google), Apple, Meta, Microsoft, Nvidia and Tesla. The chart above shows the performance of the Magnificent Seven compared to the S&P 500 – or the market as a whole. You can see the considerable outperformance of over 70pts.

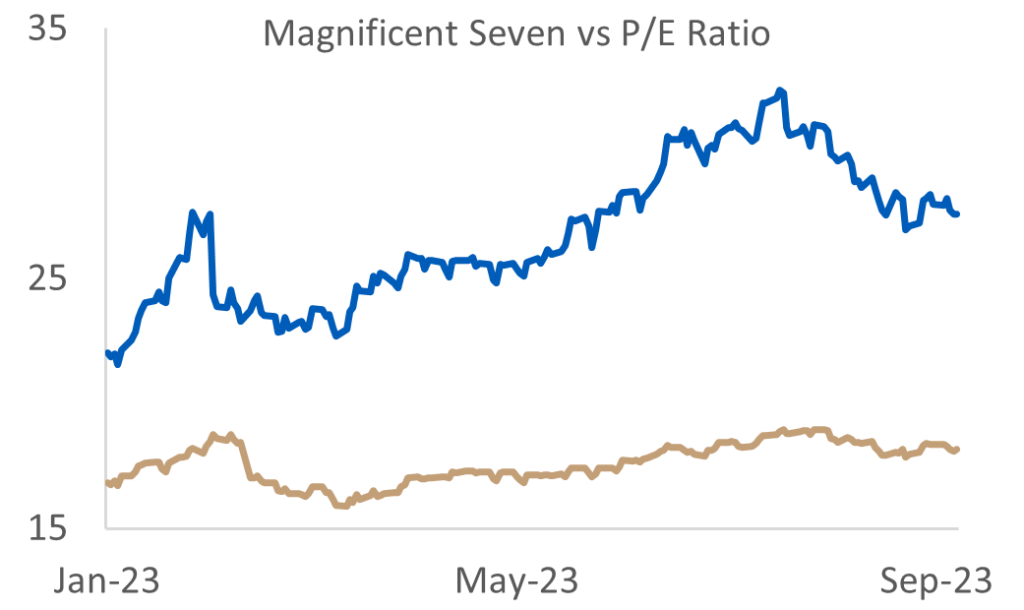

That outperformance, not surprisingly, has come with higher valuations. This next chart shows the difference in the Price-to-Earnings ratio for the Magnificent Seven and the broader market. As a reminder, the Price-to-Earnings ratio measures the multiple investors are willing to pay for each $1 of earnings twelve months from now.

The final piece of the puzzle is the growth rates for projected earnings of the Magnificent Seven as compared to the S&P 500. On an equal-weighted basis, the Magnificent Seven is expected to grow its earnings by a whopping 29% in 2024, compared to the market at 4.8%.

With those metrics in hand, it may be fair to conclude that companies in the Magnificent Seven remain at the top of everyone’s watch list. To be sure, the Seven are trading at a premium to the market, but their expected growth is nearly 6x the market for next year. Driving that growth for most of the members of the Seven is “AI”- Artificial Intelligence, the new, new thing that has swept across the globe, stirred controversy and fired the imagination of investors.

One of the questions we at Argent ask is how sustainable that difference in growth is between the Magnificent Seven and the rest of the market? It matters a lot to us, and to our clients. We have benefitted significantly from large positions in several of the Seven, and we continue to hold them. However, we invest not just for one year, but for the long-term. Is the 29% expected growth in 2024 going to continue? Is 29% growth going to continue for each and every member of the group of Seven? Is the buzz around AI deserved, understated or overstated? These are the questions we will be looking to answer over the course of the next 3 to 5 years, and will adjust our portfolios accordingly as the real winners and potential losers are identified in our new AI world.

As a reminder, we are 100% employee-owned, and we thank you for your business and your interest. If you like our market letters, videos by Ward Brown and my podcast, ‘Conversations with Ken,’ we hope you will share them with friends. In addition, whether you’re ready to invest hundreds of dollars or millions of dollars, our time-tested Mid Cap strategy has a variety of vehicles that provide convenient ways to invest. For more information on Mid Cap and our other four U.S equity strategies – Large Cap, Dividend Select, Focused Small Cap and SMID Cap, please contact [email protected].

Sincerely,

Ken Crawford

Portfolio Manager

PDF Version: Market Overview August 2023