Market Overview – November 2023

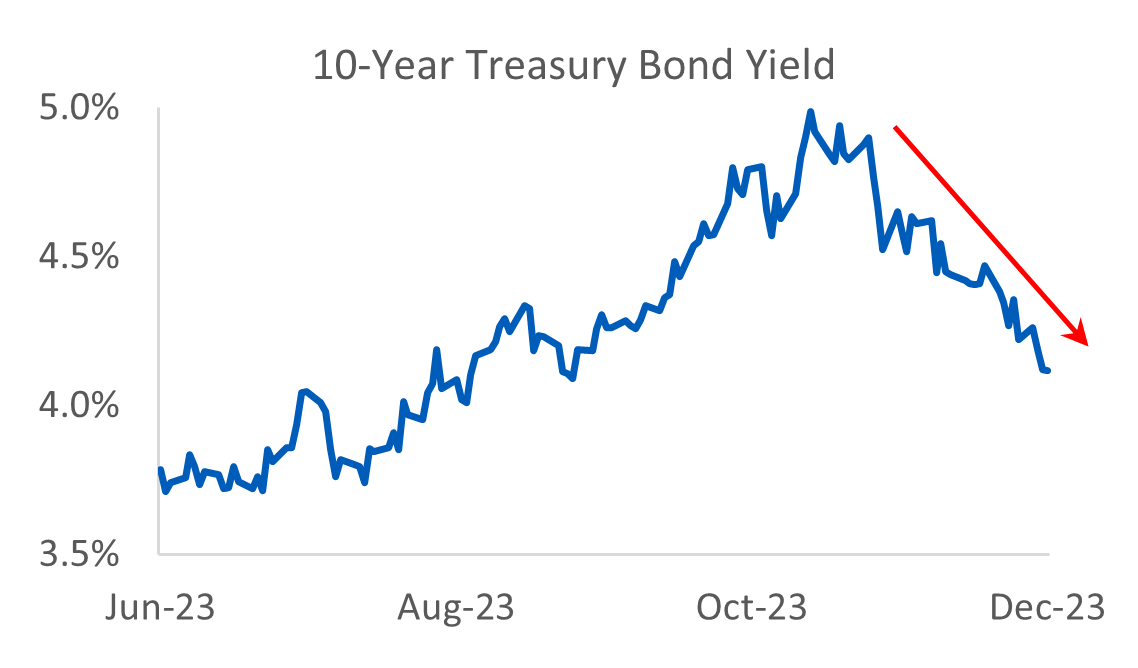

If October was the trick, November was the treat. The S&P 500 rose nearly 9% in the month, shaking off the October woes and putting this November 7th for all-time monthly returns. Driving the change in results was a host of weaker economic data, along with some dovish comments from the Federal Reserve. As a result, the stock market rose, following an inverse path relative to interest rates. As the chart below shows, the interest rate, or yield on the 10-Year Treasury bond rose into the middle of October, only to take a precipitous drop thereafter.

Expectations on interest rates and inflation have fluctuated throughout the year. Coming into 2023, consensus thought was that the Federal Reserve would be cutting rates by the second half of the year, having successfully tamed inflation. Over the course of the year, however, the adage ‘Higher for longer’ came into vogue as inflation remained stubbornly elevated. At the same time, comments from members of the Federal Reserve were perceived as hawkish, with Fed Chairman Powell saying on more than one occasion that he would prefer to overshoot on higher interest rates than undershoot.

Sticky inflation reports combined with comments from the Federal Reserve changed perceptions during the middle of the year. With more problematic inflation, fixed income investors demanded a higher return for the bonds they held, driving interest rates up. Equity investors grew increasingly fearful that a soft or zero landing for the economy was less likely and that the U.S. economy was headed for a prolonged recession. Those forces combined to drive the interest rate on the 10-Year Treasury bond up to a near-term peak of 5% in the middle of October, with the stock market falling as interest rates rose.

Nearly as fast as the fear that inflation could not be contained, a series of weaker-than-expected economic data was released. Jobs data weakened, an especially important trend given the low unemployment rate in the U.S. of 3.9%. Inflation data weakened as well, with the Consumer Price Index for October, released in the middle of November, falling to 3.2% year-over-year, marking a one and a half year low. Finally, comments at the end of November from Fed Governor Waller, an inflation hawk, that Fed policy was reasonably well positioned to slow the economy, get inflation back to 2%, and to do so without a sharp increase in unemployment was music to stock investors’ ears.

Whether this trend of better, aka lower, inflation data persists along with a reasonably strong economic backdrop will lead to a ‘soft landing’ won’t be known until 2024 fully plays out. What the near-term data and market moves suggest is that the U.S. may have turned the corner on its inflation fight, leading to lower interest rates and better times ahead. Stay tuned.

As a reminder, we are 100% employee-owned, and we thank you for your business and your interest. If you like our market letters, videos by Ward Brown and my podcast, ‘Conversations with Ken,’ we hope you will share them with friends. In addition, whether you’re ready to invest hundreds of dollars or millions of dollars, our time-tested Mid Cap strategy has a variety of vehicles that provide convenient ways to invest. For more information on Mid Cap and our other four U.S equity strategies – Large Cap, Dividend Select, Focused Small Cap and SMID Cap, please contact our client service team at [email protected].

Sincerely,

Ken Crawford

Portfolio Manager

PDF Version: Market Overview November 2023