Argent Quarterly Investment Commentary – December 2024

“An optimist is a person who sees a green light everywhere, while a pessimist sees only the red stoplight.

The truly wise person is color blind.”

– Albert Schweitzer

The year 2024 had something for everyone – a beautiful Paris Olympics, Taylor Swift-mania, an unprecedented U.S. Presidential election, and, most importantly to our clients, strong stock market returns. The S&P 500 Index wrapped up its second year in a row with over a twenty percent return, led again by technology-oriented businesses, particularly those investing in artificial intelligence (A.I.). Smaller cap stocks did not have quite the same success, but still generally posted double-digit returns.

Does a three-peat for investment returns seem possible? One never knows, but stock market investors are well-advised to curb short-term enthusiasm. There is a lot trending right, but valuations, at least in the large-cap U.S. world, are on the high-end and at some point, markets will need a breather to allow time for earnings growth to catch up.

How to best bring the investment landscape into better focus? Perhaps Benjamin Franklin can be of help. Franklin is credited with the invention of bifocals to fix both near- and far-sightedness. With our bifocals, when we peer through our long-term lens we continue to see a lot of good news. Consumer spending remains strong, labor market conditions are easing, short-term interest rates seem likely to decline, and corporate earnings are projected to be strong and relatively evenly spread among different sectors of the U.S. economy. In addition, a Trump administration is widely expected to be more pro-business – less regulation and lower taxes.

All that said, shifting our gaze to our shorter-term lens, there are potential stumbling blocks in the path. What will Trump really do, and what will simply serve as rhetoric for negotiation tactics? In addition, while Trump does have a pro-market bias, he was elected, in part, on populist themes, particularly those of higher tariffs and immigration control. Both are issues which could impact inflation, and consumers could pay more for items they purchase as new government policies are implemented.

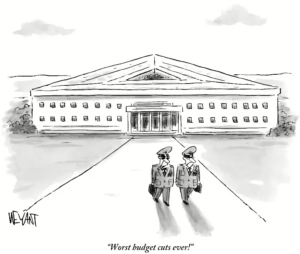

Finally, there are budgetary issues and the soaring U.S. Federal deficit. In consideration of this, Elon Musk and Vivek Ramaswamy are leading a new Department of Government Efficiency (DOGE), with a stated goal of reducing Federal spending by $500 billion. The big cuts, however, that would make a true difference are with entitlements such as Social Security and Medicare, and entitlements are currently the political third rail, too controversial for most politicians of either party to even discuss. Thus, while we admire the lofty goal, we will take a “Show Me” attitude until proven otherwise on this long-standing problem. As students of history know, arguments regarding the national debt and deficits have occurred ever since Alexander Hamilton, Thomas Jefferson and James Madison compromised in 1790 to allow the Treasury to assume state debts in exchange for the national capital to move to what is now Washington D.C. At that time, the debt was estimated to be $77 million. Oh, for the good ‘ole days!

We cannot close without also commenting on A.I. and how it continues to super-charge the stock market. Its impact can hardly be overstated. The Magnificent Seven – Apple, Microsoft, Meta, Alphabet, Tesla, NVIDIA and Amazon – represent, in aggregate, only 1.4 percent of the companies included in the S&P Index. However, those seven companies represent fourteen percent of all S&P 500 companies’ sales, thirty-one percent of all S&P companies’ sales growth, and thirty-three percent of all S&P 500 companies’ total dollar earnings. In addition, collectively they are spending hundreds of billions of dollars annually on Research and Development, more annual spending than the entire market capitalization of most other S&P giants such as Coca Cola, Home Depot and Exxon.

Bottom line, we remain positive on the stock market, but more cautious in the short-term than we have been the past few years. While the economy and corporate earnings should do well in 2025, we expect bumps along the way. As mentioned at the opening, it is normal to experience a cooling off period after two exceptional years, and to recognize that while there is reason for optimism in 2025, we need to appreciate that returns with stocks are always uneven.

PDF Version: Investment Newsletter – December 2024

(c) 2024, Argent Capital Management

Argent Capital Management, LLC is required by law to disclose all pertinent information on the firm’s operation in our Summary Disclosure Statement. Past performance is no guarantee of future results. Copies of all pertinent disclosure statements including performance are available upon request or available at www.argentcapital.com