Market Overview – April 2025

Tariff Shocks Jolt Markets, Then Reprieve Sparks Rally

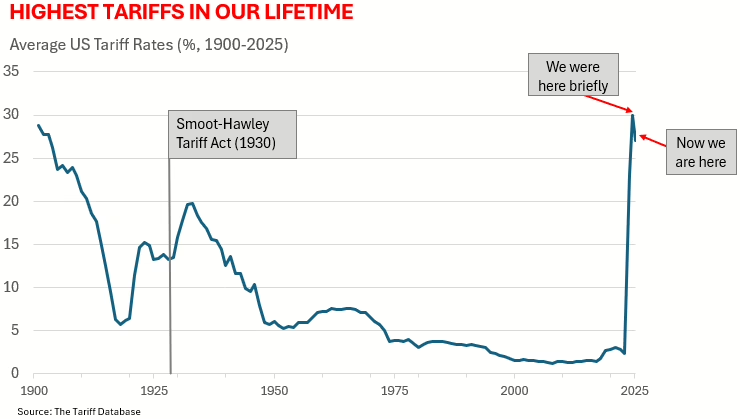

On April 2, President Trump announced ‘Liberation Day,’ as he rolled out his tariff proposals. At the low end, tariffs would rise by 10% across the globe. On the high end, tariffs on goods imported from China would rise to 145%. Although investors knew an announcement by the President was coming, the level of tariffs caught the market by surprise. According to the New York Times, “The announcement of double-digit tariffs on countries across the globe incited the worst two-day sell-off for the S&P 500 since March 2020.” By April 8th, the S&P 500 had dropped by over 12%.

Just one day later, on April 9 – a week after the surprise announcement – the Trump Administration indicated it would postpone the implementation of tariffs for 90 days as it sought to negotiate trade deals across the globe. Not surprisingly, the markets reacted favorable to this reprieve, rising over 14% from the April 8th lows.

At the end of April, weary investors saw the gyrations in the S&P 500 net out to a meager 0.3% gain for the month– a calm result belying a turbulent few weeks.

Earnings Season Surprises to the Upside

While some reprieve on tariffs certainly fueled a recovery in the last two thirds of April, there was also positive news on a fundamental basis, as companies reported results for the first quarter of 2025. According to FactSet, earnings from companies that have posted results so far have increased on average 12.8%, well above the 7.2% growth expected coming into the quarter. In addition, fears of a pullback in capital spending on the part of AI leaders proved unfounded, leading to a recovery in growth stocks through the month. Finally, during earnings calls, many companies talked up their efforts to mitigate the negative effects of tariffs.

Having said that, uncertainty remains top of mind for investors and for businesses. Several companies have withdrawn their forecasts for the rest of 2025, reflecting reduced visibility. United Airlines took the highly unusual step of providing split guidance for the year, one scenario with a recession, the other without. While companies are trying to mitigate the changes brought by tariff proposals and other initiatives coming out of Washington, many are navigating with less clarity than they’d like – and investors are feeling the same way.

Navigating Uncertainty with Enduring Businesses

It is in this environment that populating our strategies with companies that represent ‘Enduring Businesses’ is essential. We believe finding those companies that have a competitive advantage with an intelligent management team able to make appropriate investments to enhance shareholder value increases the likelihood that the stocks we hold for our clients will do well. As a reminder, Argent Capital is 100% employee-owned and we thank you for your business and your interest. In addition, if you like our market letters and videos, we hope you will share them with friends. For information on our five successful equity strategies–Large Cap U.S., Dividend Select, Mid Cap U.S, Small Cap U.S. and SMID Cap U.S., please contact [email protected].

Sincerely,

Ken Crawford

Portfolio Manager, Emeritus

PDF Version: Market Overview April 2025