Fly Over Country: The Underappreciated Opportunity in Mid-Cap Stocks

The Overlooked Opportunity

The breakdown of a domestic equity allocation is often segmented into two asset classes, large caps and small caps. Mid-cap stocks are often either overlooked entirely or believed to be adequately captured by the other two. This is a huge missed opportunity to find positive alpha (a measure of performance indicating an ability to outperform) in the mid-cap equity space – an asset class that has generated outperformance versus both large and small-caps over the last 25 years. The characteristics of the middle are consistently appealing, while the discounted valuation is providing a present opportunity. Ignoring it is to miss out on what is frequently the most compelling period of growth for companies that eventually become the behemoths of tomorrow.

The Perfect Blend of Growth and Stability

Mid-cap equities are generally classified as those companies with a market cap ranging from $2 billion to $10 billion. As the name implies, mid-caps fall between small and large caps and feature a blend of positive characteristics from each one. Companies in the mid-cap universe are often still experiencing the dynamic growth of their early days while benefiting from the stability that comes with a more mature business. As a company evolves out of its startup phase, access to capital becomes more readily available. In addition, size is not yet limiting the ability to remain nimble, achieve outsized growth, and adjust to changing market conditions.

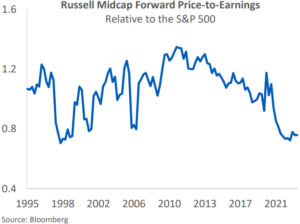

Typically, mid-caps lack the depth of Wall Street analyst coverage afforded more well-known large-cap stocks, and with less readily available research comes the opportunity for a mispricing of the business. In a broad sense, mid-cap stocks are currently priced substantially cheaper than large caps. In fact, the chart below shows that the Russell Midcap Index has not been this cheap versus the large-cap S&P 500 on a forward PE (price-to-earnings) basis since the dot-com bubble

of the late 1990s.

Consistent Outperformance

At the same time, the historical return data of the major indices supports the mid-cap case. Over the last 25 years, the Russell Midcap Index has outperformed both the large-cap S&P 500 and small-cap Russell 2000 indices on an absolute basis, as well as with dividends reinvested.

Reliable Performance with Superior Risk-Adjusted Returns

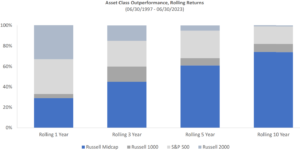

The outperformance has furthermore been distinctly consistent. While mega-cap has clearly gone through periods of excess gains over the last 10 years, mid-caps have been the best-performing asset class more often per the rolling period data below. For example, in the rolling 5-year period, mid-caps were the top performers more than 60% of the time, and for the 10-year period, that figure jumps above 70%.

Additionally, mid-cap has generated that measure of outperformance with a better risk-adjusted return profile. The Sharpe Ratio is a metric to measure investment performance after adjusting for risk. The higher the ratio, the better, implying greater returns for the amount of risk taken.

Referencing data from sources including Morningstar & Baird Research, over the last 25 years the Russell Midcap Index has produced a Sharpe of .50 versus the large-cap S&P 500 at .45 and the small-cap Russell 2000 at .35. Given the common structure of investor portfolios, it is easy to be under or completely unexposed to an opportunistic asset class representing nearly a quarter of the eligible universe. In fact, at the end of 2021, Morningstar noted only 11% of equity mutual fund assets were invested in mid-caps. That is an important statistic, as the mid-cap universe of stocks actually represents 25% of the whole. An intentional allocation to mid-cap stocks, therefore, is to take advantage of the potential for significant outperformance over the long term.

Argent Capital’s Mid Cap Strategy: High Conviction, Long-Term Investing in Quality U.S. Mid-Cap Equities

Argent Capital Management is proud to be a boutique, employee-owned investment manager in St. Louis, Missouri. For 25 years, we have built high-conviction, active portfolios of long-only U.S. equities across market caps. In order to capture the opportunity outlined above, the Argent Mid Cap strategy utilizes a blend of our proprietary quantitative Alpha model paired with an in-depth fundamental review. It produces a concentrated portfolio of high-quality, enduring businesses. An enduring business model for us includes a sustainable competitive advantage, returns on capital consistently above costs, growing cash flows, and a history of allocating capital wisely. We seek to invest in businesses that harness the power of compounding over long-term holding periods.

If you want to learn more about mid-caps or how Argent’s Enduring Business philosophy is applied to the asset class, please reach out to Kirk McDonald, CFA, Mid Cap Portfolio Manager, at 314-561-3548 or [email protected], or watch this video we put together.

PDF Version: The Underappreciated Opportunity in Mid-Cap Stocks

(c) 2024, Argent Capital Management

Argent Capital Management, LLC is required by law to disclose all pertinent information on the firm’s operation in our Summary Disclosure Statement. Past performance is no guarantee of future results. Copies of all pertinent disclosure statements including performance are available upon request or available at www.argentcapital.com