Argent Quarterly Investment Commentary – September 2024

“God is great, beer is good and people are crazy.”

– From song, People are Crazy

The country hit, “People are Crazy”, was written by two musicians trying, over drinks, to think of three things you cannot argue about. Our guess is there are some who may argue over the first two, but not the last. At times, people truly are crazy. In today’s modern world, every foolish thought, utterance or performance is on full display thanks to the internet and modern communication. It makes one pine for simpler days of black and white television and a telephone with an attached cord.

Against the backdrop of such a world, however, economic news remains a bright spot. Stocks are enjoying very strong returns year-to-date. Even September, historically the worst month for stocks, recorded impressive gains. Capping it off, one could almost picture Fed Chair Jerome Powell as a modern-day Moses, complete with tablets, walking to the podium in late September to announce a 50-basis point (one-half percent) interest rate cut. That announcement confirmed what most suspected. The Fed is recalibrating, believing they have been successful in reducing inflation close enough to their two percent target. Apparently, the new focus is to be on the weakening employment side of their mandate, with the goal being to keep the unemployment rate close to 4.0 percent, historically regarded as full employment.

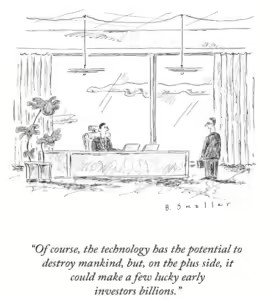

The primary index for large U.S. stocks, the S&P 500 Index, reflects the good news. It is now up close to twenty percent year-to-date, and currently trades around twenty times next year’s projected earnings. That is on the high side of a comfortable range for stocks, but not scary-high. It is probably about right if the Fed continues to reduce short-term interest rates over the winter, as most suspect. Importantly, the stock market, driven significantly by companies embracing technology and artificial intelligence (AI) in recent quarters, has over the past several months rotated more into defensive or value names. This broadening of the market bodes well for upcoming quarters.

At Argent, our five investment strategies – Large Cap, Dividend Select, Mid Cap, SMID, and Small Cap – are all performing well, both year-to-date and longer-term. Our focus on enduring businesses with strong cash flows has led to returns of which we are proud, and which compare well to peers.

As we write this, the closing days of the U.S. Presidential election cycle approach. Does it matter to the markets who wins? While the brain says yes, the data says no. We cannot help but note our concerns over policies of both candidates. Both seem to have what we call economic amnesia, and what the Wall Street Journal editorial page recently termed economic illiteracy.

Fortunately, if the polls are correct, continued gridlock has a good chance of being the real winner in November. In other words, neither side will likely receive more than a small portion of their wish list. That is probably what markets would prefer. Indeed, historical studies confirm that the U.S. stock market can do just fine under any administration. Businesses adapt quickly to changing landscapes.

Given that we know people are, at times, a little crazy, and that there is a lot going on in the coming weeks, what should we expect for the fourth quarter of 2024 and beyond? Unfortunately, our crystal ball, which works so well in the long-term, is pretty foggy about the short-term. Unexpected events can, and do, create short-term havoc from time-to-time. Thus, we would be happy to let the stock market consolidate some of its recent gains; treading water for a time, if you will. Nonetheless, we will stay fully invested, and feel good about prospects in coming quarters. Fidelity great, Peter Lynch, put it best when he said, “The real key to making money in stocks is not to get scared out of them.”

PDF Version: Investment Newsletter – September 2024

(c) 2024, Argent Capital Management

Argent Capital Management, LLC is required by law to disclose all pertinent information on the firm’s operation in our Summary Disclosure Statement. Past performance is no guarantee of future results. Copies of all pertinent disclosure statements including performance are available upon request or available at www.argentcapital.com