Nicklaus: Stocks and Bonds Deliver a Double Whammy in 2022

(St, Louis Post-Dispatch)

December 30, 2022 (David Nicklaus)

After a blissful three years when everything seemed to go up, investors had nowhere to hide in 2022.

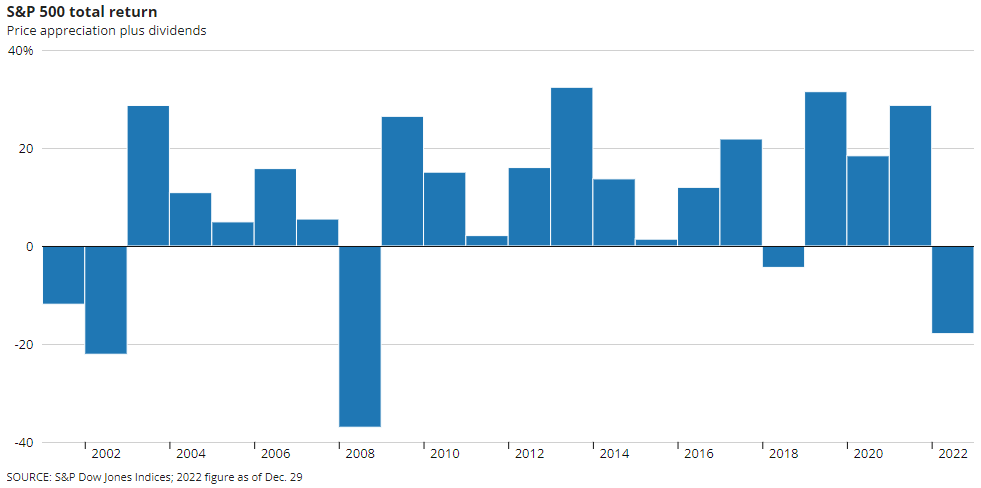

The stock market, as measured by the Standard & Poor’s 500 index, tumbled about 20%. Bonds, which normally provide a cushion from stock market turbulence, turned in a double-digit decline of their own as the Federal Reserve aggressively raised interest rates.

Factor in inflation, which erodes the portfolio’s purchasing power, and a cautious investor with equal amounts in stocks and bonds suffered the worst year since the 1930s.

Bond investors, at least, should do better in the new year. Higher interest income will offset any losses from rising rates, and the Fed is expected to be less aggressive in 2023.

“The math of it says with high confidence that bonds are going to have better returns in the next one, two or three years than they did last year,” said Norman Conley, chief investment officer at JAG Capital Management in Ladue.

Stock investors, meanwhile, are left wondering when this bear market will find a bottom. The S&P 500 stocks sell for about 17 times expected earnings, which is close to the 10-year average. A year ago, they sold for 21 times earnings.

So stocks are reasonably priced if you believe the profit numbers. Analysts polled by FactSet expect earnings to grow 5.5% in 2023.

Many economists, however, expect the economy to fall into recession by midyear.

“If that happens, you will see some erosion in earnings estimates,” said Ken Crawford, a senior portfolio manager at Argent Capital Management in Clayton. “The question is, how real is the ‘e’ part of that p/e (price-earnings) ratio?”

Mark Keller, chief executive at Confluence Investment Management in Webster Groves, wouldn’t be surprised to see the stock market fall an additional 5% or 10%. He notes, though, that stocks usually start rising about six months before the end of a recession.

Economists are predicting a relatively short and mild downturn. If that holds true, Keller sees the potential for stocks to move higher by year’s end.

“In my view, the market has largely discounted the slowdown that’s coming,” he said.

On the other hand, Scott Colbert, chief economist at Commerce Trust Co., points to the rosy earnings estimates as evidence that investors are still too optimistic.

“If you think there’s a good chance of a recession, I would tell you that financial assets haven’t bottomed out yet,” he said.

One of 2022’s striking trends was the decline of some large, well-known technology companies. Amazon’s share price fell by half, and Tesla and Meta Platforms, parent of Facebook, both lost two-thirds of their value.

With interest rates rising, investors are less willing to pay a premium for future earnings potential. Tech companies also had to acknowledge that the rapid growth they experienced early in the COVID-19 pandemic wasn’t going to continue.

Keller predicts that so-called value stocks — companies with cheaper valuations but slower growth rates — will outpace the tech darlings going forward.

“When interest rates were close to zero, you could put any kind of valuation on those growth companies, but in a rising rate environment they get hit the hardest,” he said.

Higher rates also may cause investors to reevaluate their exposure to stocks. When bonds and money-market funds were earning next to nothing, the acronym TINA, as in “there is no alternative” to stocks, became popular.

“TINA has become TIARA, ‘there is a reasonable alternative,’” Crawford said. “When all of a sudden you see 4.5% for a six-month Treasury bill, the alternative makes sense for a lot of people.”