Large Cap Commentary – March 2023

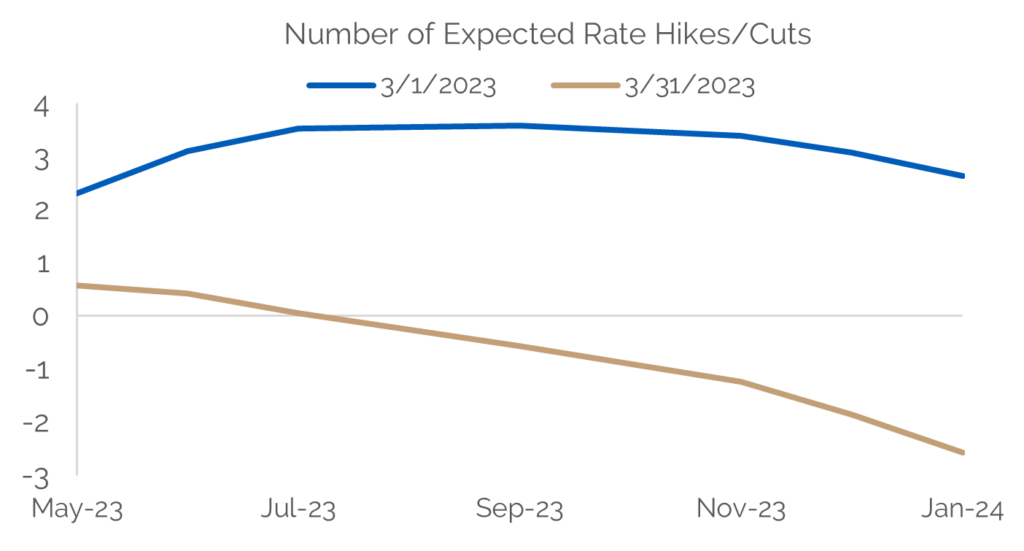

March 2023 was a play in three acts with plenty of plot twists. The protagonists: interest rates, banks and large technology companies. Additional interest rate increases seemed a high probability in early March, only for such expectations to pivot with the sudden and unexpected news of the failure of Silicon Valley Bank and Signature Bank. The other protagonist, technology companies, had an annus horribilis in 2022. That changed in the first quarter, and particularly March, on hopes for a slowing, or even a pause, in the interest rate increase agenda of the Fed.

As we all know, the Federal Reserve has raised the discount rate over the past fifteen months by 500 basis points (or 5%). This is the fastest-paced such increase in history. The discount rate is the rate of interest the Federal Reserve charges banks for short-term loans, but it carries over into setting the interest rates for most lending, both here and abroad. The discount rate is a very big deal. Clearly, a rising interest rate scenario carries the potential to have a major impact on businesses accustomed to low interest rates. As we saw in the banking industry in March, it did.

The failures of Silicon Valley Bank and Signature Bank were both sudden and unexpected. The root cause would appear to be some exceptionally poor business decisions made by the managements of these banks, decisions based on their expectations about future interest rates. In a nutshell, they guessed wrong, and, literally, had “bet the bank” on those wrong beliefs. Silicon Valley, for example, used its deposits to invest in safe but low-yielding long-term fixed-income securities to boost its earnings. This is referred to as “reaching for yield,” which grew in popularity during the low rate era. It is a strategy that works well as long as rates stay low. However, the value of those long-term securities declined rapidly as rates increased. At the same time, bank depositors began withdrawing their checking account money to invest in alternatives such as money market funds, which had begun to offer much higher returns. In order to meet the redemption requests, the bank had to sell those lower-yielding securities it had purchased at a big loss. The requests then accelerated, particularly when its business start-up clients began circulating concerns about the bank’s ability to meet redemptions. It was a classic run on the bank, and the rest is history.

It has been 15 years since the great financial crisis, but bank troubles remain fresh for those who lived through it in 2008-09. The market’s reaction to Silicon Valley’s and Signature Bank’s failures was extreme, particularly in the Financial sector, where bank and insurance stocks took a hit. To calm the storm, the Federal Reserve responded by guaranteeing the security of deposits over the $250,000 insured limit, thus, keeping with its mandate to provide stability and shore up confidence. Investors, in return, shifted their expectations to potential interest rate cuts from the Fed later this year.

As the month came to a close, the banking stress appeared to be easing and a brief rally occurred leaving stocks in positive territory for the month and quarter. Nonetheless, the 7% gain for the S&P 500® Index in March is perhaps surprising in light of all that occurred, although the average stock in the S&P 500 was only up under 1%. Whatever, given all the drama, we will take it!

As a reminder, we are 100% employee-owned, and we thank you for your business and your interest. If you like our market letters, our frequent podcast, ‘Conversations with Ken,’ and my videos, we hope you will share them with friends. In addition, whether you’re ready to invest hundreds of dollars or millions of dollars, our time-tested Mid Cap strategy has a variety of vehicles that provide convenient ways to invest. For more information on our Mid Cap and other four U.S equity strategies – Large Cap, Dividend Select, Focused Small Cap and SMID Cap, please contact [email protected].

Sincerely,

Ward Brown

Chairman of Argent Investment Committee

PDF Version: Market Overview March 2023