Large Cap Commentary – February 2023

The market fell in February, vindicating Wall Street pundits who were skeptical of the strong start to 2023. There were musings as the month progressed that the Federal Reserve may take less aggressive actions in the year, especially after Fed Chairman Powell’s comments that the economy was seeing ‘signs of disinflation.’

Some of that hope was bled out of the market when much stronger-than-expected jobs data was released at the beginning of February. That data drove the unemployment rate down to 3.4%. I have mentioned before that the last time the unemployment rate was as low as 3.5% Neil Armstrong was making history, taking the first steps on the moon in 1969; 3.4% is even lower.

There is a concept in economics called the Phillips Curve. According to Wikipedia, “The Phillips Curve is an economic model, named after William Phillips, that predicts a correlation between reduction in unemployment and increased rates of wage rises within an economy.”

Intuitively, the concept makes sense. If unemployment is low, the only way to entice someone to join the labor force is to offer them more money. That increased wage, or bribe, then spreads throughout the economy, pushing up wages for everyone. If that trend continues, the economy experiences what is known as a wage/price spiral.

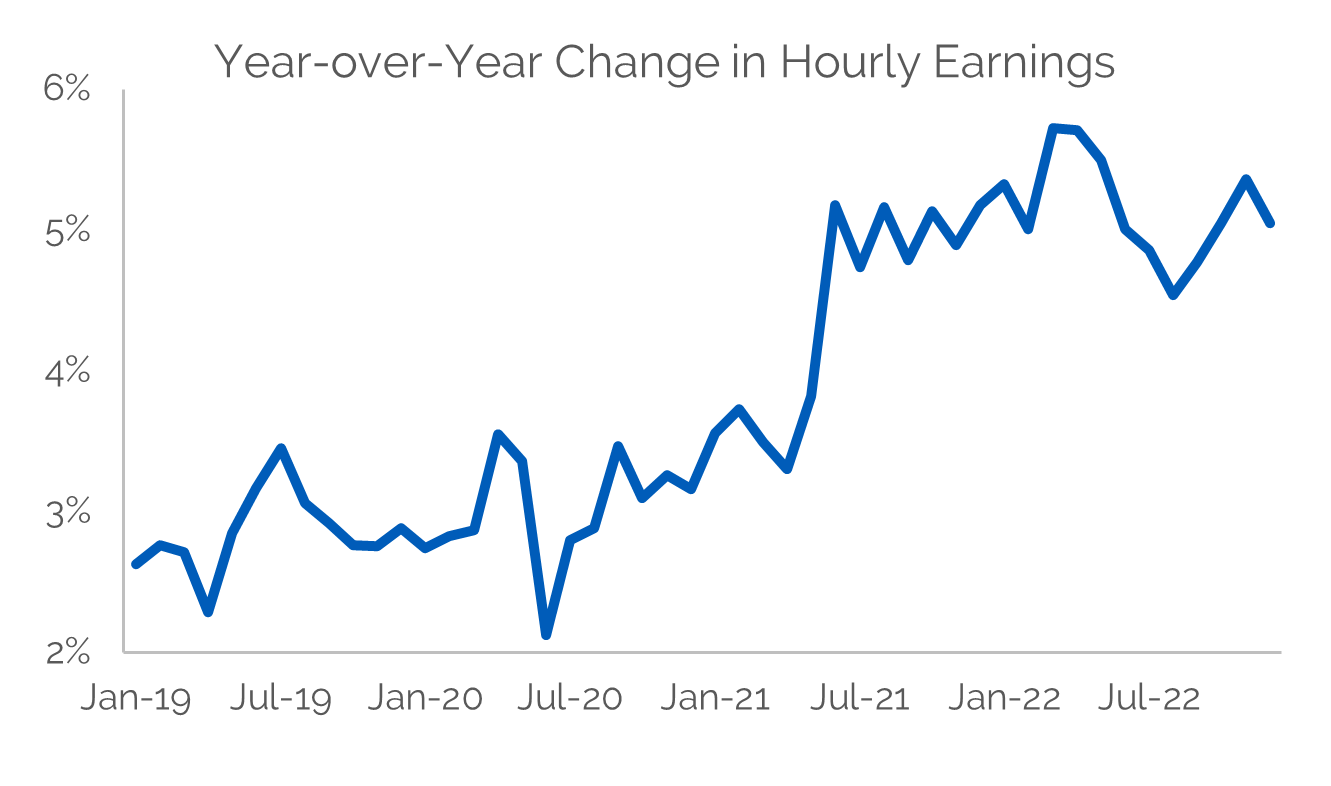

Although the Phillips Curve fell out of favor pre-pandemic, when the unemployment rate in the U.S. was a very low 3.5% without aggregate inflation, the relationship appears to be recoupling. The chart below shows the year-over-year change in hourly wages. As the unemployment rate fell and there were fewer and fewer workers to be had, wages responded and moved upward.

According to the Department of Labor, there are currently 1.9 job openings for every unemployed worker. This is troubling data for the Federal Reserve bent on slowing the economy by raising interest rates. As stronger economic data and higher inflation data were released over the course of February, high interest rates seem a given, so stock prices fell.

Anecdotal data is mixed. When we query our Main Street contacts, aka business professionals, some are experiencing slowdowns in their operations. Others are having record years, with their primary gating factors being finding more workers and new equipment.

How this all will be resolved remains unclear. Likely, until there is some loosening in the labor markets, the Federal Reserve will keep interest rates high. The question then becomes how high interest rates will rise and how long they will remain at these increased levels. Stay tuned.

Argent Capital is 100% employee-owned, and we thank you for your business and interest. In addition, if you like our market letters, videos by Ward Brown and my podcast, ‘Conversations with Ken,’ we hope you will share them with friends. For information on our five successful equity strategies–Large Cap U.S., Dividend Select, Mid Cap U.S., Small Cap U.S. and SMID Cap U.S., please contact [email protected].

Sincerely,

Ken Crawford

Portfolio Manager

PDF Version: Market Overview February 2023